The relentless march of technology continues to reshape financial landscapes, and in 2025, digital currencies are poised to solidify their position as a transformative force, especially within sectors like online gambling.

Digital currencies, encompassing cryptocurrencies and central bank digital currencies (CBDCs), are not just a futuristic concept; they are rapidly becoming a mainstream financial instrument. Understanding the market trends and growth trajectories of digital currencies in 2025 is crucial for businesses, investors, and individuals alike, particularly within the dynamic online gambling industry which is known for its early adoption of technological innovations.

Understanding the Digital Currency Landscape

Before diving into the trends and growth, it's essential to understand what digital currencies are and the different forms they take. Digital currency is a form of money available primarily in digital form, not physical, and can be managed, stored, and transacted on computer systems, mobile devices, and online platforms. This broad definition includes virtual currencies and cryptocurrencies, but the term is increasingly associated with central bank digital currencies (CBDCs).

Cryptocurrencies, like Bitcoin and Ethereum, operate on decentralized blockchain technology, offering transparency and security through cryptography. They are characterized by their volatility and speculative nature, driven by market supply and demand. Conversely, CBDCs are digital forms of a nation's fiat currency, issued and regulated by the central bank, aiming to combine the efficiency and security of digital currencies with the stability of traditional money.

The distinction is crucial as both types of digital currencies are influencing market trends and growth in different ways. Cryptocurrencies are driving innovation and adoption in decentralized finance (DeFi) and various online sectors, while CBDCs promise to modernize payment systems and enhance financial inclusion under governmental oversight.

Key Market Trends Shaping Digital Currency Growth in 2025

Several key trends are expected to propel the growth of digital currencies in 2025, shaping their market dynamics and adoption across various sectors.

Increased Institutional Adoption

One of the most significant trends is the increasing institutional adoption of digital currencies. Major financial institutions, including banks, investment firms, and payment processors, are no longer on the sidelines. They are actively exploring and integrating digital currencies into their operations. This shift is driven by a growing recognition of the potential benefits, including enhanced efficiency, reduced transaction costs, and access to new markets. For example, companies like MicroStrategy and Tesla have already invested portions of their corporate treasuries in Bitcoin, signaling a broader trend of corporate acceptance.

This institutional influx brings substantial capital and legitimacy to the digital currency market, reducing volatility and fostering a more mature ecosystem. As institutions develop sophisticated custody solutions and regulatory frameworks become clearer, we can expect even greater participation, particularly in cryptocurrencies like Bitcoin and Ethereum, which are seen as established players.

Central Bank Digital Currencies (CBDCs) Advancement

2025 is likely to see significant advancements in the development and implementation of CBDCs globally. Several countries are in advanced stages of piloting or even launching their own digital currencies. China's digital yuan (e-CNY) is already in pilot phase, with millions of transactions processed. The European Central Bank is actively exploring a digital euro, and the Federal Reserve in the United States is researching the potential for a digital dollar. These initiatives signal a global movement towards modernizing financial infrastructure.

CBDCs promise to streamline payment systems, reduce reliance on cash, and potentially enhance financial inclusion by providing access to digital financial services for underserved populations. For the online gambling industry, CBDCs could offer faster, cheaper, and more secure payment options, potentially reducing the friction associated with traditional banking methods and credit card transactions.

Regulatory Clarity and Development

Regulatory uncertainty has long been a hurdle for the widespread adoption of digital currencies. However, in 2025, we anticipate greater regulatory clarity as governments and international bodies work towards establishing comprehensive frameworks. The European Union's MiCA (Markets in Crypto-Assets) regulation, for example, is a landmark effort to create a unified regulatory approach for crypto-assets across member states. Similarly, in the United States, various agencies are actively working on defining regulatory perimeters for digital currencies.

Clearer regulations will provide businesses with the confidence to invest in and integrate digital currencies, knowing the legal boundaries and compliance requirements. This is particularly important for the online gambling industry, which operates in a heavily regulated environment. Defined rules around digital currency usage will enable operators to adopt these technologies more confidently and responsibly.

Growth of Decentralized Finance (DeFi)

Decentralized Finance (DeFi) continues to be a hotbed of innovation within the digital currency space. DeFi platforms aim to replicate traditional financial services, such as lending, borrowing, and trading, in a decentralized and transparent manner, using smart contracts on blockchains. While DeFi is still nascent and faces challenges related to security and scalability, it holds immense potential to disrupt traditional finance.

In 2025, we expect DeFi to mature further, with improvements in user experience, security protocols, and interoperability between different DeFi platforms. For the gambling industry, DeFi could offer new avenues for provably fair gaming, decentralized betting platforms, and innovative loyalty programs, potentially attracting a new generation of tech-savvy gamblers.

NFTs and Metaverse Integration

Non-Fungible Tokens (NFTs) gained significant traction in recent years, primarily in art and collectibles. However, their utility is expanding beyond these initial use cases. In 2025, we anticipate deeper integration of NFTs with digital currencies and the metaverse. NFTs can represent ownership of digital assets within virtual worlds, creating new economies and forms of digital interaction.

For online gambling, NFTs could revolutionize in-game assets, virtual casinos in the metaverse, and unique player experiences. Imagine owning a rare virtual poker table as an NFT or using NFTs to represent loyalty points or VIP access within online casinos. These integrations could create more engaging and immersive gambling experiences, attracting a new wave of players.

Factors Driving Digital Currency Growth in 2025

Several factors are contributing to the anticipated growth of digital currencies in 2025, spanning technological advancements, economic shifts, and evolving consumer preferences.

Technological Advancements

Continuous technological advancements in blockchain technology, cryptography, and digital infrastructure are fundamental drivers of digital currency growth. Scalability solutions for blockchains, such as layer-2 protocols and sharding, are improving transaction speeds and reducing costs, making digital currencies more practical for everyday use. Advancements in cryptography enhance security and privacy, addressing key concerns around digital asset security.

Furthermore, the development of more user-friendly wallets, exchanges, and payment gateways is making digital currencies more accessible to a broader audience. As technology matures, the barriers to entry for using and adopting digital currencies are lowered, fostering wider adoption across different demographics.

Economic and Geopolitical Factors

Economic and geopolitical factors are also playing a significant role in driving digital currency growth. In times of economic uncertainty or geopolitical instability, digital currencies, particularly decentralized cryptocurrencies, are often seen as alternative stores of value or hedges against inflation. Concerns about inflation in traditional economies and the potential for currency devaluation can drive investors towards digital assets.

Moreover, in regions with unstable financial systems or limited access to traditional banking, digital currencies offer a viable alternative for payments and remittances. This is particularly relevant in emerging markets where mobile penetration is high but banking infrastructure is less developed. Digital currencies can empower individuals and businesses in these regions to participate in the global digital economy.

Changing Consumer Preferences

Changing consumer preferences, especially among younger generations, are also fueling the growth of digital currencies. Digital natives are more comfortable with online transactions and digital assets. They are drawn to the convenience, speed, and often lower fees associated with digital currency payments. Furthermore, there is a growing demand for privacy and control over personal finances, which decentralized digital currencies can offer.

The online gambling industry, with its predominantly younger and tech-savvy demographic, is particularly well-positioned to benefit from these changing consumer preferences. Offering digital currency payment options can enhance player satisfaction, attract new customers, and provide a competitive edge in the market.

Impact of Digital Currency Growth on the Gambling Industry in 2025

The growth of digital currencies in 2025 will have a profound impact on the online gambling industry, transforming various aspects of its operations and player experience.

Enhanced Payment Systems

Digital currencies offer significant advantages for online gambling payment systems. Transactions are typically faster and cheaper compared to traditional methods like credit cards or bank transfers. Cryptocurrency transactions, in particular, often have lower fees and faster processing times, benefiting both operators and players. CBDCs, when implemented, could offer similar efficiencies with the added stability of government-backed currency.

Furthermore, digital currencies can facilitate cross-border transactions more seamlessly, which is crucial for the global online gambling industry. They can reduce currency conversion costs and complexities associated with international payments, streamlining operations for operators and providing players with more flexible payment options.

Increased Player Privacy and Security

Privacy and security are paramount concerns for online gamblers. Digital currencies, especially cryptocurrencies, can offer enhanced privacy compared to traditional payment methods. While transactions are recorded on a public blockchain, they are pseudonymous, meaning they are not directly linked to personal identities in the same way as bank accounts or credit cards. This can appeal to players who value their privacy online.

Moreover, the cryptographic security of blockchain technology makes digital currency transactions highly secure, reducing the risk of fraud and chargebacks, which are common challenges in the online gambling industry. This enhanced security benefits both operators and players, fostering trust and confidence in digital currency payment options.

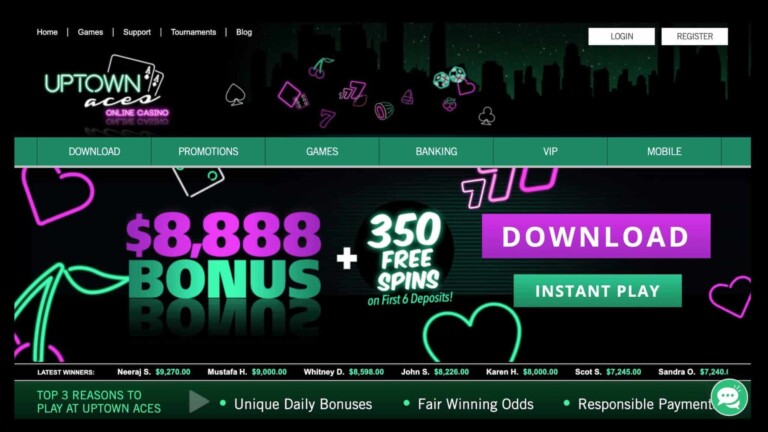

New Marketing and Player Acquisition Strategies

The adoption of digital currencies can open up new marketing and player acquisition strategies for online gambling operators. Offering digital currency payment options can attract a tech-savvy demographic and differentiate operators from competitors. Operators can also leverage digital currencies for innovative promotions and loyalty programs, such as cryptocurrency-based bonuses or NFTs as rewards.

Furthermore, digital currencies can facilitate access to new markets, particularly in regions where traditional banking infrastructure is limited or where there is a strong preference for digital payments. This can expand the reach of online gambling operators and tap into previously underserved player bases.

Challenges and Considerations for Gambling Operators

While the growth of digital currencies presents numerous opportunities for the gambling industry, operators also need to consider certain challenges and navigate potential risks.

Volatility remains a key concern, particularly with cryptocurrencies. The fluctuating value of cryptocurrencies can impact gambling operators' revenue and player balances. Operators need to implement risk management strategies to mitigate volatility risks, such as hedging or converting cryptocurrency holdings to stablecoins or fiat currency promptly.

Regulatory compliance is another critical consideration. Operators must ensure they comply with all relevant regulations related to digital currencies in their jurisdictions, including anti-money laundering (AML) and know your customer (KYC) requirements. Navigating the evolving regulatory landscape requires ongoing monitoring and adaptation.

Furthermore, educating players and staff about digital currencies is essential. Many players may be unfamiliar with using digital currencies for online gambling. Operators need to provide clear and accessible information and support to facilitate the adoption of these new payment methods. Staff training is also crucial to ensure they can handle digital currency transactions and address player inquiries effectively.

Case Studies and Examples

To illustrate the growing adoption and impact of digital currencies, let's examine a couple of case studies and examples.

Case Study 1: Cryptocurrency Adoption in a Leading Online Casino

A leading online casino, "CasinoXYZ," integrated cryptocurrency payments in 2023. By 2025, they reported that cryptocurrency transactions accounted for over 30% of their total payment volume. They attracted a younger demographic of players and saw a significant increase in player retention due to faster payouts and enhanced privacy. CasinoXYZ also implemented a cryptocurrency-based loyalty program, offering exclusive bonuses and rewards to players using digital currencies, further driving adoption.

This case study demonstrates the tangible benefits of cryptocurrency adoption for online gambling operators, including increased revenue, player acquisition, and enhanced player loyalty. It highlights the importance of not just offering digital currency payments but also integrating them into marketing and player engagement strategies.

Example 2: CBDC Pilot Program in a Gambling Jurisdiction

In a hypothetical jurisdiction, "GamingLand," the government launched a CBDC pilot program in 2024. Online gambling operators in GamingLand were encouraged to participate in the pilot, accepting the CBDC as a payment method. Early results in 2025 showed that the CBDC offered faster transaction processing and reduced transaction costs compared to traditional banking methods. Players also appreciated the convenience and security of using the government-backed digital currency for online gambling.

This example illustrates the potential of CBDCs to streamline online gambling payments and enhance player experience. As more countries advance their CBDC initiatives, we can expect to see similar pilot programs and wider adoption in regulated gambling jurisdictions.

Future Outlook for Digital Currency in Gambling Beyond 2025

Looking beyond 2025, the trajectory of digital currency growth in the gambling industry is expected to continue upwards. Several long-term trends suggest that digital currencies will become increasingly integral to online gambling operations and player experience.

Continued Mainstreaming and Acceptance

As digital currencies become more mainstream and widely accepted across various sectors, their adoption in the gambling industry will naturally accelerate. Increased familiarity and trust among consumers, coupled with clearer regulations and improved infrastructure, will pave the way for broader integration. We can expect to see more online casinos and betting platforms not only accepting digital currencies but also actively promoting them as preferred payment methods.

Innovation in Gambling Products and Services

Digital currencies will drive further innovation in gambling products and services. DeFi and blockchain technologies can enable new forms of provably fair gaming, decentralized betting platforms, and peer-to-peer gambling models. NFTs and metaverse integrations will create immersive and engaging virtual casino experiences, attracting a new generation of players and blurring the lines between gaming and gambling.

Global Expansion and Market Access

Digital currencies will facilitate the global expansion of the online gambling industry, enabling operators to reach new markets and players in regions with limited access to traditional financial services. Cross-border payments will become more seamless and cost-effective, reducing geographical barriers and fostering a more interconnected global gambling market. This expansion will also drive competition and innovation, benefiting players with more choices and better experiences.

Conclusion: Embracing the Digital Currency Revolution in Gambling

In conclusion, 2025 is shaping up to be a pivotal year for digital currencies, with significant market trends and growth drivers poised to transform various industries, including online gambling. For gambling operators, embracing the digital currency revolution is not just about adopting new payment methods; it's about positioning themselves for the future of online entertainment and finance. By understanding the trends, navigating the challenges, and leveraging the opportunities, the gambling industry can unlock new levels of efficiency, player engagement, and global reach in the digital currency era. As the digital currency landscape continues to evolve, staying informed, adaptable, and innovative will be key to success in this dynamic and exciting market.

External Resources: