Cryptocurrency’s surge in popularity is undeniably reshaping numerous sectors, and the gambling industry is no exception; its integration is prompting a significant re-evaluation of gambling laws worldwide, presenting both opportunities and complex regulatory challenges for casinos, lawmakers, and gamblers alike.

The Advent of Cryptocurrency in Online Gambling

Cryptocurrency, with its promise of anonymity, decentralization, and faster transactions, has rapidly permeated the online gambling landscape. Bitcoin, Ethereum, Litecoin, and numerous other digital currencies are now commonly accepted across a growing number of online casinos and gambling platforms. This shift is driven by several factors attractive to both operators and players.

For operators, cryptocurrencies often translate to lower transaction fees compared to traditional banking methods, reduced risks of chargebacks, and access to a broader international player base, circumventing geographical restrictions and varying financial regulations. For gamblers, the allure lies in enhanced privacy, faster deposit and withdrawal times, and potentially lower costs. The decentralized nature of crypto also appeals to those wary of traditional financial institutions and governmental oversight.

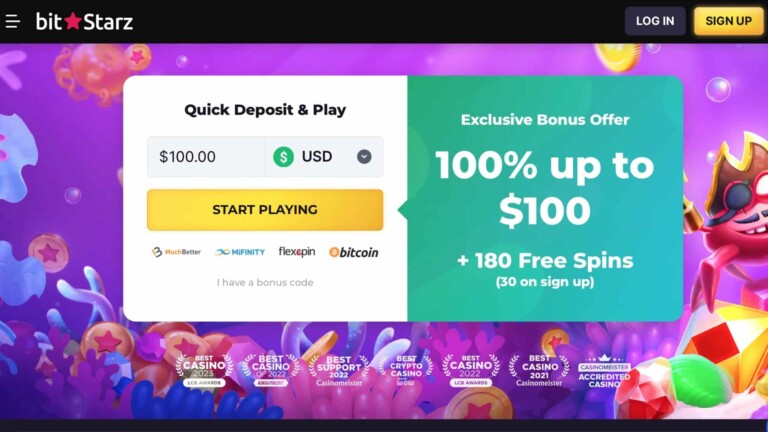

This integration has spawned a new wave of online casinos exclusively operating with cryptocurrencies, often referred to as “crypto casinos” or “Bitcoin casinos.” These platforms frequently boast provably fair gaming systems, leveraging blockchain technology to ensure transparency and randomness in game outcomes, addressing a long-standing concern among online gamblers regarding the fairness of algorithms.

Challenges to Existing Gambling Laws

The decentralized and borderless nature of cryptocurrency presents a significant challenge to established gambling laws, which are typically jurisdiction-specific and predicated on fiat currencies and traditional financial systems. Gambling legislation globally is diverse, ranging from outright prohibition to highly regulated markets with stringent licensing and compliance requirements. The introduction of crypto complicates enforcement and oversight across several key areas:

Jurisdictional Ambiguity

Cryptocurrencies operate outside the control of central banks and national governments, making it challenging to determine the jurisdiction under which crypto gambling platforms should be regulated. Many crypto casinos operate offshore, often licensed in jurisdictions with lax gambling regulations or none at all. This raises questions about which country’s laws should apply when players from regulated jurisdictions access these platforms. For example, a player in the United Kingdom, where online gambling is strictly regulated by the UK Gambling Commission, might access a crypto casino licensed in Curaçao, creating a regulatory grey area.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance

Traditional gambling regulations heavily rely on AML and KYC procedures to prevent money laundering, terrorist financing, and underage gambling. These procedures often involve verifying player identities, monitoring transactions, and reporting suspicious activities to financial intelligence units. The pseudonymity afforded by some cryptocurrencies can make it harder for operators to conduct effective KYC checks and for regulators to trace illicit funds. While many reputable crypto casinos implement KYC measures, the inherent nature of crypto transactions poses a greater challenge compared to fiat-based systems where transactions are more easily traceable through banks and payment processors.

Regulators are particularly concerned about the potential for crypto gambling platforms to be used for laundering proceeds of crime. The anonymity features can obscure the origin and destination of funds, making it difficult to track illegal activities. This concern is amplified by the global nature of crypto transactions, which can easily cross borders, further complicating law enforcement efforts.

Taxation and Revenue Collection

Gambling taxes are a significant source of revenue for many governments, often earmarked for public services or problem gambling initiatives. However, the use of cryptocurrencies in gambling can complicate tax collection. Tracking and taxing winnings and gambling revenue in crypto is more complex than in fiat currencies due to the decentralized nature of transactions and the fluctuating value of cryptocurrencies. Furthermore, the anonymity features can make it harder for tax authorities to identify and audit crypto gambling operators and players.

Governments are grappling with how to adapt tax laws to effectively capture revenue from crypto gambling activities. Some jurisdictions are exploring ways to trace crypto transactions and require exchanges and operators to report taxable activities. However, international cooperation and technological solutions are needed to address the cross-border nature of crypto gambling and ensure fair tax collection.

Consumer Protection and Responsible Gambling

Gambling regulations are also designed to protect consumers and promote responsible gambling practices. This includes measures to prevent underage gambling, provide tools for self-exclusion, and offer support for problem gamblers. The anonymity and ease of access offered by crypto gambling platforms can undermine these protections. For instance, underage individuals might find it easier to gamble using crypto without age verification, and problem gamblers might find it harder to self-exclude effectively from platforms that operate outside traditional regulatory frameworks.

Regulators are exploring ways to extend consumer protection measures to the crypto gambling space. This includes requiring crypto casinos to implement robust age verification and responsible gambling tools, as well as ensuring that players have access to dispute resolution mechanisms and support services. However, enforcing these measures across decentralized and offshore platforms presents significant challenges.

Regulatory Responses Globally

The global regulatory response to crypto gambling is still evolving and highly fragmented. Different jurisdictions are taking varying approaches, reflecting diverse attitudes towards both gambling and cryptocurrency. Some are attempting to integrate crypto gambling within existing frameworks, while others are adopting a more cautious or prohibitive stance.

Jurisdictions Embracing Regulation

Some jurisdictions are proactively seeking to regulate crypto gambling within their existing frameworks. For example, Malta, an early adopter of online gambling regulation, has attempted to create a regulatory framework for crypto casinos. The Malta Gaming Authority (MGA) has issued guidance on the use of cryptocurrencies and blockchain technology in gambling, aiming to balance innovation with regulatory oversight. However, the practical implementation and effectiveness of these frameworks are still being tested.

Other jurisdictions, like the Isle of Man and Curaçao, which are known for their online gambling licenses, are also adapting their regulations to accommodate crypto gambling. They are focusing on incorporating AML and KYC requirements for crypto transactions and ensuring that licensed operators adhere to responsible gambling standards. However, the enforcement capacity and resources of these smaller jurisdictions can be limited, raising concerns about the overall effectiveness of their oversight.

Jurisdictions with Cautious Approaches

Many major gambling jurisdictions, including the United Kingdom, the United States, and several European countries, are taking a more cautious approach to crypto gambling. While not outright banning crypto gambling, they are subjecting it to intense scrutiny and applying existing gambling regulations, often designed for fiat currencies, to crypto transactions. The UK Gambling Commission, for example, requires licensed operators accepting cryptocurrencies to comply with stringent AML and KYC rules and to demonstrate the source of funds for crypto deposits.

In the United States, the regulatory landscape is complex and varies by state. While some states have legalized online gambling, the application of these laws to crypto gambling is still unclear. Federal regulations, such as the Unlawful Internet Gambling Enforcement Act (UIGEA), also add another layer of complexity. The lack of clear federal guidance and the fragmented state-level regulations create uncertainty for both operators and players in the US market.

Jurisdictions Prohibiting or Restricting Crypto Gambling

Some jurisdictions have taken a more restrictive stance, either prohibiting crypto gambling outright or imposing significant limitations. China, for example, has banned all forms of online gambling, including crypto gambling, as part of its broader crackdown on cryptocurrency activities. Other countries with strict gambling laws, such as some nations in the Middle East, are also likely to prohibit or severely restrict crypto gambling.

Even in jurisdictions where online gambling is generally permitted, regulators may impose restrictions on crypto gambling due to concerns about AML, KYC, and consumer protection. These restrictions could include limiting the types of cryptocurrencies that can be accepted, imposing lower deposit and withdrawal limits for crypto transactions, or requiring additional licensing and compliance measures for crypto gambling operators.

Impact on Gamblers: Opportunities and Risks

For gamblers, the rise of crypto gambling presents a mixed bag of opportunities and risks. Understanding these aspects is crucial for making informed decisions and engaging responsibly with crypto gambling platforms.

Potential Benefits for Gamblers

Enhanced Privacy: Cryptocurrency transactions can offer a higher degree of privacy compared to traditional banking methods. While not fully anonymous, crypto transactions do not directly link to personal bank accounts, which can appeal to players who value discretion. However, it’s important to note that complete anonymity is rarely achievable, especially with KYC requirements at reputable crypto casinos and increasing blockchain analysis capabilities.

Faster Transactions: Crypto transactions are typically processed much faster than traditional bank transfers or credit card payments, especially for international transactions. Deposits and withdrawals at crypto casinos are often instant or near-instant, providing a smoother and more efficient gambling experience. This speed is a significant advantage for players who value quick access to their funds.

Lower Fees: Transaction fees associated with cryptocurrencies can be lower than those charged by banks or payment processors, particularly for international transactions. This can translate to cost savings for both operators and players, potentially leading to better payouts or bonuses at crypto casinos.

Provably Fair Gaming: Many crypto casinos utilize provably fair gaming systems, which leverage blockchain technology to allow players to verify the randomness and fairness of game outcomes. This transparency can build trust and address concerns about rigged games, a common worry in the online gambling world. Players can independently check the cryptographic algorithms to ensure that the casino is not manipulating results.

Accessibility and Global Reach: Crypto gambling platforms can be more accessible to players in jurisdictions with strict gambling regulations or limited access to traditional online gambling options. The decentralized nature of crypto can circumvent geographical restrictions, allowing players from around the world to participate. This global reach can also lead to a wider variety of games and platforms to choose from.

Potential Risks for Gamblers

Lack of Regulation and Consumer Protection: A significant risk is the lack of robust regulation and consumer protection on many crypto gambling platforms, particularly those operating offshore or licensed in lax jurisdictions. Players may have limited recourse in case of disputes, unfair practices, or platform failures. The absence of strong regulatory oversight increases the risk of encountering rogue operators or scams.

Volatility of Cryptocurrency Values: The value of cryptocurrencies is notoriously volatile, which can impact gambling outcomes. Winnings that seem substantial in crypto terms can quickly diminish in fiat value if the cryptocurrency’s price drops. Conversely, losses can also become magnified if the value of the cryptocurrency increases after a gambling session. This volatility adds an extra layer of financial risk for gamblers.

AML and KYC Concerns (for players): While anonymity is often touted as a benefit, the lack of stringent AML and KYC procedures on some platforms can also be a risk for players. It can expose them to platforms that are less reputable or potentially involved in illicit activities. Furthermore, in regulated jurisdictions, players may still be required to declare crypto gambling winnings for tax purposes, despite the perceived anonymity of crypto transactions.

Problem Gambling Risks: The ease of access, speed of transactions, and perceived anonymity of crypto gambling can exacerbate problem gambling behaviors. The 24/7 availability of online platforms, combined with the ease of depositing and wagering crypto, can make it harder for individuals to control their gambling habits. The lack of traditional responsible gambling measures on some platforms further compounds this risk.

Security Risks and Scams: The crypto space is susceptible to scams, hacks, and security breaches. Players using unregulated or less secure crypto gambling platforms risk losing their funds to cyberattacks or fraudulent operators. It’s crucial to choose reputable and licensed crypto casinos with strong security measures, but even then, risks remain inherent in the digital realm.

The Future of Crypto Gambling and Regulation

The future of crypto gambling and its regulation remains uncertain and will likely depend on the evolving regulatory landscape for both cryptocurrencies and online gambling globally. Several trends and potential developments are worth considering:

Increased Regulatory Scrutiny: As crypto gambling gains further traction, regulatory scrutiny is expected to intensify. Governments and gambling authorities will likely seek to close regulatory loopholes, enhance AML and KYC requirements, and strengthen consumer protection measures for crypto gambling activities. This could lead to stricter licensing regimes, increased compliance burdens for operators, and greater enforcement actions against unregulated platforms.

Technological Solutions for Compliance: Blockchain technology itself may offer solutions for regulatory compliance in crypto gambling. For example, blockchain-based identity verification systems could enhance KYC processes while preserving user privacy. Smart contracts could automate responsible gambling measures, such as deposit limits and self-exclusion mechanisms. Regulators and operators may increasingly explore and adopt these technologies to address compliance challenges.

International Cooperation and Harmonization: Given the cross-border nature of crypto gambling, international cooperation among regulators is crucial. Efforts to harmonize regulatory standards, share information, and coordinate enforcement actions across jurisdictions are likely to increase. International bodies and organizations may play a role in facilitating this cooperation and developing best practices for crypto gambling regulation.

Mainstream Adoption and Integration: As regulatory clarity emerges and compliance solutions mature, crypto gambling could become more integrated into the mainstream online gambling industry. Traditional online casinos may increasingly adopt cryptocurrencies as payment options, and licensed operators may launch dedicated crypto gambling platforms. This integration could bring crypto gambling under more established regulatory frameworks and consumer protection regimes.

Continued Innovation and Evolution: The crypto and gambling industries are both highly innovative and rapidly evolving. New cryptocurrencies, blockchain technologies, and gambling platforms are constantly emerging. Regulators will need to remain agile and adaptable to keep pace with these innovations and ensure that regulations remain effective and relevant in the face of ongoing technological change.

Concluding Thought

Cryptocurrency is undeniably transforming the gambling industry, presenting a complex interplay of opportunities and challenges. For gamblers, it offers potential benefits like enhanced privacy and faster transactions, but also carries risks related to regulation, volatility, and security. For lawmakers and regulators, crypto gambling necessitates a re-evaluation of existing laws and the development of new approaches to address jurisdictional ambiguity, AML/KYC compliance, taxation, and consumer protection. The future of crypto gambling will depend on how effectively these challenges are addressed and how well regulations can adapt to the decentralized and rapidly evolving nature of cryptocurrency technology. As the landscape continues to evolve, both gamblers and regulators must navigate this new frontier with caution, awareness, and a commitment to responsible and sustainable practices.

External Resources: