The global gambling market is undergoing a seismic shift, marked by rapid technological advancements and evolving consumer preferences, setting the stage for significant trends and growth in 2025; this dynamic industry, encompassing everything from online casinos to sports betting and lotteries, is projected to experience substantial expansion, driven by increasing internet penetration, mobile gaming adoption, and the legalization of gambling in new territories.

The Ascendancy of Online Gambling Platforms

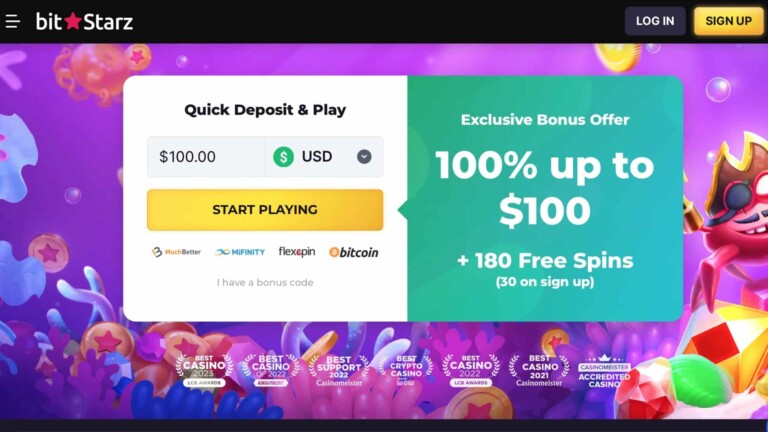

Online gambling is no longer a niche segment but has firmly established itself as a dominant force within the global gambling market. The convenience, accessibility, and wide array of gaming options offered by online platforms are attracting a growing number of players worldwide. This surge is fueled by the increasing availability of high-speed internet and the proliferation of smartphones, making online casinos and betting sites readily accessible to a vast global audience. For instance, in regions with newly regulated online gambling markets, such as parts of North America and expanding regions in Asia, there has been a notable migration of players from traditional brick-and-mortar establishments to online platforms, seeking enhanced privacy, broader game selections, and attractive bonuses.

Mobile gaming is a critical component of this online revolution. Gamblers increasingly prefer to engage with their favorite games on the go, utilizing smartphones and tablets for seamless access to casino games and sports betting platforms. This mobile-first approach is compelling online operators to optimize their platforms for mobile devices, focusing on user-friendly interfaces, mobile-specific promotions, and dedicated apps to enhance the player experience. The integration of mobile payment solutions further streamlines the gambling process, making it easier than ever for users to deposit and withdraw funds directly from their mobile devices. According to industry analysts, mobile gambling is expected to constitute over 60% of the total online gambling revenue by 2025, underscoring its pivotal role in market growth.

Live dealer games are another innovation significantly impacting the online casino landscape. These games bridge the gap between the digital and physical casino experience by offering real-time interaction with human dealers via live video streams. Live blackjack, roulette, and baccarat are becoming increasingly popular, providing players with the excitement and social interaction of a land-based casino from the comfort of their homes. This format appeals particularly to players who value authenticity and trust, as it offers transparency and eliminates concerns about the randomness of purely digital games. The technological infrastructure supporting live dealer games is becoming more sophisticated, with improved video quality, multiple camera angles, and interactive chat features, further enhancing the immersive experience.

Regional Growth Hotspots: Asia-Pacific and North America

While the global gambling market is expanding across various regions, Asia-Pacific and North America are emerging as key growth hotspots in 2025. The Asia-Pacific region, driven by countries like China, India, and Southeast Asian nations, is anticipated to be the largest and fastest-growing gambling market globally. This growth is underpinned by a large and youthful population, increasing disposable incomes, and a cultural affinity for gambling. While mainland China maintains strict regulations on gambling, special administrative regions like Macau continue to be major gambling hubs, attracting high-roller clientele from across Asia. Furthermore, several Southeast Asian countries are gradually liberalizing their gambling laws, recognizing the economic benefits of regulated gambling industries.

India presents a particularly compelling growth opportunity, with its massive population and burgeoning middle class. While gambling regulations in India are complex and vary by state, the online gambling market is experiencing rapid expansion, albeit often through offshore operators. The increasing smartphone penetration and affordable mobile data plans are enabling millions of Indians to access online gambling platforms. The potential for regulated online gambling in India is immense, and any significant regulatory changes could unlock substantial market growth. Similarly, Southeast Asian nations like Vietnam, Thailand, and Indonesia, despite varying degrees of regulatory restrictiveness, exhibit strong gambling cultures and are witnessing a rise in both land-based and online gambling activities.

North America, particularly the United States and Canada, is another region experiencing robust gambling market growth. The repeal of the Professional and Amateur Sports Protection Act (PASPA) in 2018 in the US paved the way for the legalization of sports betting at the state level, triggering a wave of market liberalization across the country. Numerous states have since legalized online and retail sports betting, and this trend is expected to continue, driving significant revenue growth. Furthermore, online casino gaming is also gaining traction in several US states, with more jurisdictions considering legalization to tap into the lucrative online gambling market. Canada is also witnessing growth in its online gambling sector, with provinces like Ontario launching regulated online gaming markets, attracting both domestic and international operators.

Technological Innovations Shaping the Future of Gambling

Technological innovation is the engine driving transformation within the gambling industry. Emerging technologies are not only enhancing the player experience but also revolutionizing operational aspects, from security and fraud prevention to marketing and customer engagement. Artificial intelligence (AI) and machine learning (ML) are playing an increasingly significant role in personalizing the gambling experience. AI-powered systems can analyze player behavior, preferences, and spending patterns to offer tailored game recommendations, personalized bonuses, and targeted marketing campaigns. This level of personalization enhances customer satisfaction and loyalty, driving repeat business and maximizing revenue potential. Furthermore, AI is being deployed to detect and prevent fraudulent activities, identify problem gambling behaviors, and ensure responsible gaming practices are upheld.

Virtual Reality (VR) and Augmented Reality (AR) technologies hold immense potential to revolutionize the online casino experience, although their widespread adoption is still in its nascent stages. VR casinos can offer fully immersive 3D environments where players can interact with virtual dealers and other players in a simulated casino setting. This technology can replicate the social atmosphere of land-based casinos, appealing to players seeking a more engaging and interactive online experience. AR, on the other hand, can overlay digital gaming elements onto the real world, potentially creating innovative hybrid gambling experiences. While VR and AR gambling are not yet mainstream, advancements in headset technology and content development are expected to accelerate their adoption in the coming years, potentially becoming more prominent trends by 2025 and beyond.

Blockchain and cryptocurrency technologies are also making inroads into the gambling industry, primarily in the online sector. Cryptocurrencies like Bitcoin offer several advantages for online gambling operators and players, including faster and cheaper transactions, enhanced privacy, and greater security. Blockchain technology can also be used to ensure the fairness and transparency of online games, with provably fair algorithms that can be independently verified. While regulatory frameworks for cryptocurrency gambling are still evolving, the adoption of these technologies is expected to increase as the industry seeks to cater to tech-savvy players and streamline payment processes. Smart contracts, enabled by blockchain, could automate payouts and ensure transparent and secure betting processes, reducing the risk of disputes and enhancing trust in online gambling platforms.

Regulatory Landscape and Responsible Gambling Initiatives

The global gambling market operates within a complex and evolving regulatory landscape. Governments worldwide are grappling with the challenges of regulating online gambling, balancing the potential economic benefits of gambling revenue with the social costs associated with problem gambling. The trend towards legalization and regulation of online gambling is expected to continue in 2025, as more jurisdictions recognize the inevitability of online gambling and seek to bring it within a regulated framework to generate tax revenue and protect consumers. However, regulatory approaches vary significantly across different regions and countries. Some jurisdictions adopt a comprehensive licensing regime, allowing a wide range of online gambling activities, while others may impose stricter restrictions, limiting the types of games permitted or imposing high tax rates.

Responsible gambling is becoming an increasingly critical focus for regulators, operators, and industry stakeholders. As gambling becomes more accessible, particularly online, there is a growing awareness of the need to mitigate the risks of problem gambling and protect vulnerable individuals. Regulatory bodies are implementing stricter measures to promote responsible gambling, including age verification checks, deposit limits, self-exclusion programs, and responsible advertising guidelines. Operators are also investing in responsible gambling tools and technologies, such as AI-powered algorithms that can detect early signs of problem gambling behavior and trigger interventions. The industry is moving towards a more proactive and data-driven approach to responsible gambling, recognizing that sustainability depends on ensuring a safe and responsible gambling environment for all players.

The interplay between regulation and innovation will be crucial in shaping the future of the gambling market. Regulations need to be adaptable and forward-looking to keep pace with rapid technological advancements and evolving consumer behaviors. Overly restrictive regulations could stifle innovation and drive players to unregulated black markets, while lax regulations could exacerbate problem gambling issues. Finding the right balance is a key challenge for policymakers worldwide. Collaborative efforts between regulators, operators, technology providers, and responsible gambling organizations are essential to create a sustainable and responsible gambling ecosystem that benefits both the industry and society.

Economic Factors and Market Dynamics

The global economic climate and broader market dynamics significantly influence the gambling industry's trajectory. Economic growth generally correlates with increased discretionary spending, which can translate to higher gambling expenditure. Conversely, economic downturns or recessions can lead to a contraction in gambling activity as consumers tighten their belts and prioritize essential spending. However, the gambling industry has historically demonstrated a degree of resilience to economic fluctuations, particularly in certain segments like lotteries, which may even see increased participation during times of economic uncertainty as people seek affordable entertainment and the hope of a large win.

Inflationary pressures and changes in consumer spending patterns are also impacting the gambling market. Rising inflation can erode disposable incomes, potentially leading to a reduction in gambling expenditure, especially in discretionary segments like casino gaming and sports betting. Operators may need to adapt their pricing strategies and promotional offers to remain competitive and attract price-sensitive consumers. Furthermore, the shift towards experiential spending, where consumers prioritize experiences over material goods, could benefit the gambling and entertainment industry, as gambling is often viewed as a form of entertainment and leisure activity. Operators that can offer compelling and engaging experiences, both online and offline, are likely to thrive in this evolving consumer landscape.

Mergers and acquisitions (M&A) and industry consolidation are ongoing trends in the global gambling market. As the market matures and competition intensifies, operators are increasingly looking to M&A to achieve scale, expand their geographic footprint, and diversify their product offerings. Consolidation can lead to greater efficiencies, cost synergies, and enhanced market power for the merged entities. However, it can also raise regulatory concerns about market concentration and potential anti-competitive practices. The pace of M&A activity in the gambling industry is expected to remain robust in 2025, as operators seek to position themselves for long-term growth in a dynamic and competitive global market. These strategic moves are reshaping the competitive landscape and creating larger, more diversified gambling conglomerates with global reach.

Sports Betting Expansion and Esports Integration

Sports betting is experiencing a period of unprecedented growth globally, fueled by legalization in new markets, the increasing popularity of online betting platforms, and the integration of in-play betting options. The US sports betting market, in particular, is expanding rapidly, with more states legalizing sports wagering and established operators vying for market share. Major professional sports leagues are increasingly embracing sports betting, recognizing its potential to enhance fan engagement and generate new revenue streams. The convergence of sports and gambling is becoming more pronounced, with sports teams and leagues partnering with gambling operators and integrating betting content into their broadcasts and digital platforms. This trend is expected to accelerate in 2025, further blurring the lines between sports and gambling entertainment.

Esports betting is emerging as a significant growth segment within the sports betting market, appealing to a younger, digitally native demographic. The global esports audience is rapidly expanding, and betting on esports tournaments and matches is gaining mainstream acceptance. Major gambling operators are increasingly incorporating esports betting into their platforms, offering a wide range of betting markets on popular esports titles like League of Legends, Counter-Strike: Global Offensive, and Dota 2. The dynamic and fast-paced nature of esports lends itself well to in-play betting, further enhancing the excitement and engagement for bettors. The esports betting market is projected to experience exponential growth in 2025 and beyond, becoming an integral part of the broader sports betting ecosystem. Its appeal to a younger demographic makes it a crucial area of focus for operators looking to future-proof their businesses.

The integration of sports betting with media and entertainment is creating new opportunities for cross-promotion and content convergence. Gambling operators are partnering with media companies to create betting-related content, such as pre-game previews, in-game analysis, and post-game recaps, further integrating gambling into the sports viewing experience. This content integration can enhance fan engagement and drive betting activity. Furthermore, the rise of legal sports betting is leading to increased advertising and marketing spend by gambling operators, particularly in newly regulated markets. This heightened marketing activity is raising the profile of sports betting and attracting new customers to the market. The synergy between sports, media, and gambling is expected to intensify in 2025, creating a more interconnected and immersive entertainment landscape.

Conclusion: A Market Poised for Continued Expansion

The global gambling market in 2025 is poised for continued expansion, driven by a confluence of factors including technological advancements, regional market liberalization, and evolving consumer preferences. Online gambling, particularly mobile and live dealer formats, will remain a primary growth driver, while Asia-Pacific and North America will be key regional hotspots. Technological innovations like AI, VR/AR, and blockchain will further transform the industry, enhancing player experiences and operational efficiencies. The regulatory landscape will continue to evolve, with a growing emphasis on responsible gambling and consumer protection. Economic factors and market dynamics, including inflation and industry consolidation, will shape the competitive landscape. Sports betting and esports integration will further fuel market growth, creating new opportunities and blurring the lines between gambling and other forms of entertainment. For gamblers, this dynamic market offers an ever-expanding array of choices, from innovative online gaming experiences to new and exciting betting opportunities, underscoring the importance of informed and responsible engagement with this evolving industry.

External Resources: