The world of online gambling has evolved significantly over the last decade. With advancements in technology, players now have access to a variety of payment methods to fund their gaming sessions. Among these options, credit cards and cryptocurrencies stand out as two of the most popular and widely used payment methods. Both have their own unique advantages, but what happens when you combine the benefits of credit cards and crypto? In this article, we will explore how leveraging both payment methods can enhance your gambling experience, offering you convenience, security, and potentially greater rewards. Whether you're a new player or a seasoned gambler, understanding how to combine these methods could be the key to maximizing your online casino journey.

Understanding the Basics of Credit Cards and Crypto for Gambling

Before diving into the strategies of combining credit cards and cryptocurrency, it's essential to understand the basics of each payment method.

What are Credit Cards?

Credit cards are widely accepted in the world of online gambling. They allow players to make instant deposits and withdrawals, making them a convenient payment method. Credit cards work by borrowing funds from a financial institution, which the user is required to pay back within a set time frame. For gambling, players can use credit cards such as Visa, MasterCard, and American Express to fund their accounts quickly. The advantage of using credit cards is their familiarity and ease of use, along with extensive consumer protection mechanisms that can offer peace of mind in case of disputes or fraud.

What is Cryptocurrency?

Cryptocurrency is a decentralized digital currency that relies on blockchain technology to ensure secure, transparent transactions. Bitcoin, Ethereum, Litecoin, and others have become popular choices for online gambling, offering advantages such as low transaction fees, fast processing times, and increased privacy. Unlike credit cards, cryptocurrencies are not tied to any central authority, allowing players to maintain a degree of anonymity. For many, this is particularly appealing when gambling online, as it provides greater control over their financial activities.

The Advantages of Credit Cards in Online Gambling

Credit cards offer several advantages for online gamblers. While they may not have the same privacy benefits as cryptocurrencies, their ease of use and widespread acceptance make them a popular choice. Here’s why:

1. Instant Deposits and Withdrawals

Credit cards allow players to make instant deposits into their casino accounts. This means you can start playing your favorite games immediately without waiting for the funds to clear. Many casinos also allow instant withdrawals to credit cards, although the time it takes to process a withdrawal can vary depending on the casino’s policy.

2. Familiarity and Convenience

Credit cards are one of the most familiar and widely used payment methods worldwide. Most players are accustomed to using them for everyday transactions, so using them for online gambling feels seamless. Additionally, since most people have at least one credit card, they don’t need to create new accounts or sign up for third-party payment services to start gambling online.

3. Strong Consumer Protection

One of the most significant benefits of using credit cards is the strong consumer protection they offer. If you encounter fraud or unauthorized charges, many credit card companies have buyer protection policies in place to dispute these charges and help resolve issues. This adds an extra layer of security for online gamblers, which is particularly important when engaging in financial transactions online.

The Advantages of Cryptocurrencies in Online Gambling

While credit cards have their advantages, cryptocurrencies offer a different set of benefits that can enhance the gambling experience in unique ways.

1. Increased Anonymity and Privacy

One of the main appeals of using cryptocurrencies for online gambling is the increased anonymity they provide. Transactions made with Bitcoin or other cryptocurrencies don’t require players to disclose personal details such as their name, address, or credit card number. This makes cryptocurrencies particularly attractive for those who value privacy and want to keep their gambling activities discreet.

2. Lower Transaction Fees

Traditional credit card companies charge transaction fees, which can add up over time. Cryptocurrencies, on the other hand, often have lower fees compared to credit cards and traditional banking methods. While some cryptocurrencies may have small network fees associated with transactions, they are generally much cheaper than credit card fees, making them a cost-effective choice for frequent gamblers.

3. Fast Transactions and Borderless Payments

Cryptocurrencies offer fast and efficient transactions. Unlike credit cards, which may take a few business days to process withdrawals, cryptocurrency transactions are typically completed within minutes. This is particularly useful for players who want to quickly access their winnings or make deposits without delays. Additionally, cryptocurrencies are borderless, meaning they can be used anywhere in the world, eliminating issues related to currency exchange rates or geographic restrictions.

How to Combine Credit Cards and Cryptocurrency for Maximum Benefits

Now that we've explored the individual benefits of both credit cards and cryptocurrencies, let’s look at how combining the two payment methods can enhance your gambling experience. By using both in tandem, players can capitalize on the strengths of each method while minimizing their weaknesses.

1. Use Credit Cards for Fast Deposits and Crypto for Withdrawals

One strategy that many players use is to fund their casino accounts using a credit card and then withdraw their winnings using cryptocurrency. This approach leverages the instant deposit benefits of credit cards, allowing players to start playing immediately. Once you’ve won, you can withdraw your funds to a cryptocurrency wallet, where the transaction is usually faster and comes with lower fees compared to traditional withdrawal methods.

2. Protect Your Identity with Crypto While Enjoying Credit Card Rewards

Another way to combine the benefits of both methods is by using a credit card to make purchases that earn you rewards (such as cashback or travel points) while also using cryptocurrency to maintain privacy. By using credit cards for everyday purchases and earning rewards, you can accumulate valuable benefits that can be redeemed later. Meanwhile, using crypto for your gambling transactions ensures that your identity remains protected.

3. Minimize Fees by Using Crypto for Large Transactions

If you’re planning to make large deposits or withdrawals, using cryptocurrency can save you money on transaction fees. Since credit card companies charge fees on large payments, switching to a cryptocurrency payment method for higher amounts can minimize these costs. This strategy works especially well for seasoned gamblers who want to avoid unnecessary fees on large sums.

4. Take Advantage of Crypto Bonuses and Promotions

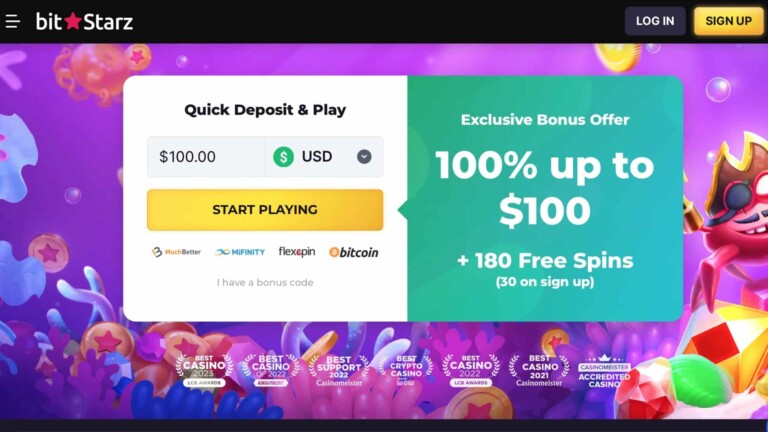

Some online casinos offer exclusive bonuses and promotions for players who use cryptocurrency as their payment method. If you’re combining credit cards and crypto for your gambling transactions, you can take advantage of these crypto-exclusive bonuses while also benefiting from the convenience and rewards of using credit cards. It’s a win-win situation for players who want to maximize their bonuses and overall experience.

Real-World Examples: Combining Credit Cards and Cryptocurrencies

Let’s look at a few real-world examples of how players can successfully combine credit cards and cryptocurrencies to enhance their online gambling experience.

Example 1: The Casual Gambler

Sarah enjoys playing online slots and table games in her free time. She uses her Visa credit card to deposit funds quickly and easily, allowing her to jump straight into the action. After a few successful sessions, Sarah decides to withdraw her winnings. Instead of waiting for a bank transfer, she opts to withdraw her funds using Bitcoin, taking advantage of lower transaction fees and faster processing times. She’s able to access her funds almost instantly, all while maintaining her privacy and avoiding the high fees typically associated with traditional banking methods.

Example 2: The High Roller

John is a more experienced gambler who often places larger bets on sports and casino games. To minimize transaction fees, John deposits funds into his casino account using his credit card but chooses to withdraw his winnings through Ethereum. This allows him to avoid the hefty fees associated with credit card withdrawals, saving him money in the long run. By using crypto for his withdrawals, John also ensures that his gambling transactions remain private and secure.

Conclusion: A Balanced Approach to Online Gambling

Combining credit cards and cryptocurrencies can significantly improve your online gambling experience. While credit cards offer ease of use, instant deposits, and strong consumer protection, cryptocurrencies provide privacy, lower fees, and faster transaction times. By strategically using both methods, you can enjoy the best of both worlds—accessing instant funds, saving on fees, and maintaining privacy. Whether you’re a casual player or a high roller, understanding how to combine these two payment methods effectively will give you an edge in the ever-evolving world of online gambling.