The burgeoning realm of online gambling presents a fascinating paradox when viewed through the lens of public finance: is it merely a form of entertainment, or does it function as a hidden tax, subtly siphoning funds from individuals and channeling them towards both private operators and government coffers?

Understanding the Basics: Taxes and Gambling

To explore whether online gambling acts as a hidden tax, it’s crucial to first understand what constitutes a tax in the conventional sense. Taxes are compulsory financial charges levied by governments on individuals or entities to fund public services and infrastructure. These can be broadly categorized into direct taxes, such as income tax and property tax, and indirect taxes, like sales tax and value-added tax (VAT). Direct taxes are levied directly on income or wealth, while indirect taxes are imposed on transactions or consumption.

Hidden taxes, on the other hand, are less transparent and often embedded within the prices of goods or services. Inflation, for example, can be considered a hidden tax, as it erodes the purchasing power of money without being explicitly levied. Similarly, some argue that certain fees or charges imposed by private entities, especially in heavily regulated sectors, can function like hidden taxes if they disproportionately burden consumers and generate revenue streams that indirectly benefit the government through various channels.

Traditional gambling, and increasingly online gambling, occupies a unique space in this fiscal landscape. Governments worldwide have long recognized the revenue-generating potential of gambling, often taxing winnings, gambling operators, or both. The taxation of gambling winnings varies significantly by jurisdiction. In some countries, like Canada and Australia, gambling winnings are generally not taxed, considering them to be luck-based windfalls rather than a regular source of income. Conversely, in the United States and many European nations, gambling winnings above a certain threshold are subject to income tax, often with provisions for deducting losses.

The “Hidden Tax” Argument: Deconstructing Online Gambling

The argument for online gambling being a hidden tax primarily rests on the inherent mechanics of gambling itself, particularly the concept of the house edge. The house edge is the statistical advantage that the casino or gambling operator holds over players in any given game. It is mathematically built into the game’s rules, ensuring that over the long run, the operator will consistently make a profit, while players, in aggregate, will lose. This inherent advantage functions as a form of mandatory extraction of value from players, irrespective of whether they win or lose in the short term.

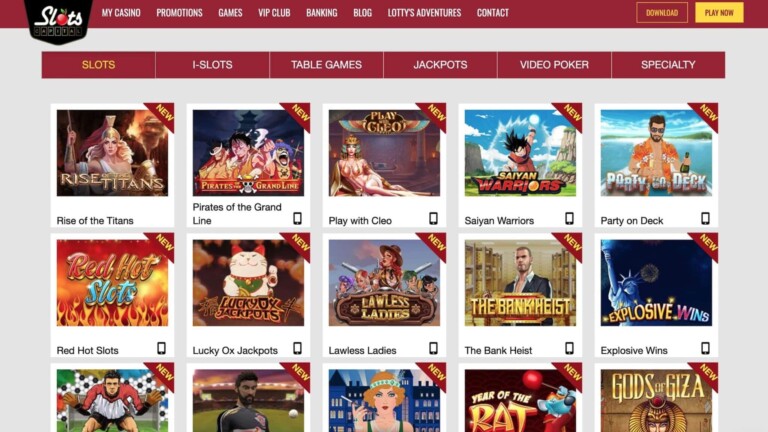

Consider a slot machine with a 5% house edge. For every $100 wagered on this machine over a significant period, statistically, the operator expects to retain $5, while players collectively receive $95 back in winnings. This $5, multiplied across millions of bets placed daily on online gambling platforms, aggregates into substantial revenue for operators. This revenue stream, derived directly from player losses due to the house edge, can be interpreted as a form of taxation, albeit one levied by private companies rather than the government directly.

Furthermore, the revenue generated by online gambling operators is itself subject to taxation by governments. Corporation tax, gambling taxes, and licensing fees are common levies imposed on the gambling industry. In the UK, for example, online gambling operators are subject to a tax on their gross gaming revenue, which is a percentage of the total stakes minus winnings paid out. This means that a portion of the money lost by gamblers, facilitated by the house edge, ultimately flows to the government in the form of tax revenue. In this sense, online gambling can be seen as an efficient, albeit indirect, tax collection mechanism.

The regressive nature of gambling further strengthens the hidden tax argument. Studies have shown that gambling, particularly forms like slot machines and lottery games prevalent in online casinos, tends to disproportionately impact lower-income individuals. These demographics often spend a larger proportion of their disposable income on gambling compared to wealthier individuals. If online gambling is viewed as a hidden tax, it becomes a regressive tax, taking a larger percentage of income from those who can least afford it. This regressivity is a common criticism leveled against lotteries and other forms of state-sanctioned gambling, and it extends to the online sphere.

Counterarguments and Nuances: Is it Really a Tax?

Despite the compelling arguments, it’s crucial to acknowledge the counterarguments and nuances that complicate the “hidden tax” analogy. Firstly, participation in online gambling is fundamentally voluntary. Unlike income tax or sales tax, individuals are not compelled to gamble. The decision to engage in online gambling is a personal choice, and losses incurred are arguably the result of freely chosen entertainment expenditure, similar to paying for a movie ticket or a concert.

Secondly, gambling offers entertainment value, and for many, it is a leisure activity enjoyed for its thrill and potential for reward. The money spent on gambling can be viewed as payment for this entertainment experience. While the house edge ensures long-term losses, the short-term possibility of winning and the enjoyment derived from the activity are part of the value proposition. This entertainment aspect distinguishes gambling from taxation, which is purely a mandatory financial levy without direct reciprocal entertainment value.

Moreover, gambling is not solely about losses; it also presents the possibility of winnings. While the house edge favors the operator, individual players can and do win, sometimes substantial amounts. These winnings, particularly in jurisdictions where they are tax-free, can offset previous losses and provide a tangible financial benefit. The potential for gains, however statistically improbable in the long run due to the house edge, differentiates gambling from a straightforward tax, which offers no prospect of direct financial return to the payer.

Furthermore, the gambling industry, including online gambling, generates significant economic benefits beyond tax revenue. It creates employment, supports associated industries like software development and marketing, and contributes to tourism in some regions. Governments often justify the legalization and regulation of gambling based on these economic benefits, arguing that the tax revenue generated is used to fund public services, offsetting any potential social costs associated with gambling addiction. This economic contribution is a factor that distinguishes gambling from a purely extractive tax system.

Case Studies: Examining Gambling Taxation in Practice

Examining different jurisdictions reveals varying approaches to gambling taxation and its impact. In the United Kingdom, the online gambling sector has faced scrutiny over its tax rate. The General Betting Duty (GBD), which applies to online gambling, is currently set at 21% of gross gaming revenue, increased from 15% in 2014. Operators have voiced concerns that further tax increases could harm the industry and potentially drive business offshore. This highlights the delicate balance governments must strike between maximizing tax revenue from gambling and maintaining a competitive and viable gambling industry.

Conversely, some jurisdictions adopt a lower tax approach to gambling, focusing on volume and attracting operators. Malta, for instance, has historically been a popular base for online gambling companies due to its relatively low tax rates and favorable regulatory environment. This strategy aims to generate revenue through licensing fees, corporate tax, and indirect economic benefits, rather than heavily taxing gross gaming revenue. The success of this approach depends on attracting a large volume of operators and maintaining a robust regulatory framework.

Analyzing the house edge in specific games further illustrates the “hidden tax” concept in action. Consider online blackjack, often touted as a game with a relatively low house edge, sometimes as low as 1% or even less under optimal conditions and with perfect player strategy. However, even this seemingly small percentage, when applied to millions of hands played across an online casino platform, generates substantial revenue for the operator over time. For a player wagering $10 per hand over 1,000 hands, a 1% house edge translates to an expected loss of $100. While individual session outcomes can vary, the long-term statistical reality of the house edge functions as a predictable revenue stream for operators, akin to a percentage-based tax on player wagers.

Psychological and Behavioral Dimensions: The Illusion of Control

The psychological and behavioral aspects of gambling significantly contribute to the “hidden tax” perception. Cognitive biases, such as the illusion of control and loss aversion, play a crucial role in shaping gambling behavior. The illusion of control leads gamblers to overestimate their ability to influence game outcomes, even in games of pure chance. This can encourage continued gambling despite losses, as players believe they can “turn their luck around” or develop strategies to overcome the house edge, a mathematically improbable feat.

Loss aversion, a well-documented psychological phenomenon, describes the tendency for individuals to feel the pain of a loss more strongly than the pleasure of an equivalent gain. In gambling, this can manifest as chasing losses, where players attempt to recoup previous losses by placing even larger bets, often exacerbating their financial situation. These psychological factors can make online gambling particularly compelling and potentially addictive, blurring the lines between voluntary entertainment expenditure and a less conscious, almost automatic, outflow of funds driven by ingrained biases and game mechanics designed to exploit them.

Responsible gambling initiatives aim to mitigate these risks by promoting awareness of the house edge, encouraging realistic expectations, and providing resources for problem gambling. However, the inherent design of gambling products, with their built-in house edge and psychological hooks, inevitably leads to aggregate player losses, contributing to the perception of online gambling as a system that, while not a formal tax, shares some of its revenue-extracting characteristics.

Conclusion: A Nuanced Perspective on Online Gambling

In conclusion, the question of whether online gambling is a hidden tax is not a simple yes or no. While online gambling is not a government-imposed tax in the formal sense, it exhibits several characteristics that align with the concept of a hidden, consumption-based levy. The house edge functions as a mathematically guaranteed extraction of value from players, losses contribute to a substantial revenue stream taxed by governments, and the regressive nature of gambling raises equity concerns. However, online gambling is also a voluntary form of entertainment, offering potential winnings and generating economic benefits. The “cost” of gambling can be viewed as entertainment expenditure, and the industry provides jobs and contributes to the economy.

Ultimately, viewing online gambling as a “hidden tax” is a useful analogy for understanding its financial dynamics and potential societal impacts. It highlights the inherent revenue-generating mechanism embedded within gambling products and encourages a more critical perspective on its economic and social role. Whether one considers it a hidden tax or simply a form of entertainment, responsible gambling practices and informed consumer awareness are crucial to navigating the complexities of the online gambling landscape.

External Resources: